Tuesday 30th of May 2023

EASE TALKS n°5 – Update on the energy costs crisis and its impact on the European sport sector

After holding the board meeting for May 2023, EASE members shared their views on the past winter to update the analysis realised in November 2022 on the consequences of the energy costs crisis on the European sport sector. At that time, EASE consulted all their partners from all over Europe to measure how sports structures dealt with the energy costs crisis since the summer of 2022. Specific national insights from EASE members and partners helped understand the current situation of the European sport movement in the face of this crisis.

In the face of a situation where energy prices rose considerably in almost every market in Europe between July and September 2022 (price changes ranged from 25% to more than 300%), the European Union intervened in energy markets to help member states. In early winter, some temporary emergency intervention policy measures were also implemented at the national level to tackle high electricity prices, such as electricity demand reduction measures and revenue caps on electricity producers.

Later on, these measures became permanent through winter in most countries, and the European Commission worked on different policies to reduce gas prices: after encouraging a voluntary gas demand reduction of 15% between August 2022 and March 2023 and implementing a gas demand reduction plan to help member states, new measures were adopted in December 2023 to make gas more affordable and introduce a market correction mechanism in periods of excessively high hub prices (see detailed Eurostat report here).

Even though 2022 was marked by great difficulties regarding energy supplies in Europe, and sports structures entered winter with significant worries about this context, they finally coped with the situation better than expected.

A mixed but optimistic feeling about sports structures after winter

As energy prices were increasingly rising all along the summer of 2022 and were still rising in November, sports structures feared financial difficulties, and even bankruptcy, for the winter of 2022. In addition to rising energy prices, which mainly concerned gas and electricity (oil was also a concern in some countries), European countries also had to face the resurgence of inflation. It increased food and daily prices for all households and companies that were therefore confronted with financial difficulties.

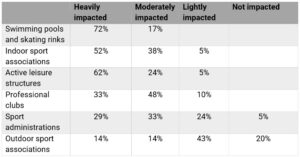

Unsurprisingly, the most impacted structures in the sports sector have been the indoor sports associations, the active leisure structures and the professional clubs in May 2023, which shows the same result as in November 2023.

* These percentages have been calculated from the answers received from national authorities in 21 European countries.

A few months later, the situation was finally better than expected from sports structures. Prices are now dropping once again, even though they are still higher than they used to be, and sports structures were able to cope with the winter more easily than they had imagined.

The crisis has been partially absorbed thanks to solutions inspired by governments and sports structures. Indeed, measures being prepared or starting to be implemented in November 2022 are now established in numerous countries: around one-third of European countries now present cap prices on gas and electricity and diverse mechanisms of subsidies and compensations have been implemented at the national level.

In addition to the European market measures that aim to reduce energy prices and impact any country’s structures, governments implemented direct financial support for sports structures. This financial support took the form of compensation related to energy prices or some subsidies for small businesses or associations (including sports structures). A few countries implemented subsidies specific to the sports sector (such as the Netherlands or Slovenia), but sports structures could mainly benefit from policies applied to small businesses or associations. Through these provisions, sports structures could continue operating, avoiding bankruptcy and reducing closures of sports facilities, whereas these were their main worries in November 2022.

Apart from these company-oriented measures, some countries chose to intervene in households by reducing VAT on electricity prices (Finland) or establishing compensation towards households instead of businesses (Denmark).

A great diversity of provisions was implemented in the sports sector, with a significant intervention of public authorities to support the financial sustainability of sports structures. Apart from these particular measures, this period has also been an excellent occasion for sports structures to broaden the reflection on energy consumption and energy efficiency.

An awareness-raising moment for the sport movement?

In addition to a brutal financial impact, this crisis may have also had a more profound impact on sports structures management: a critical awareness has been spread among the sport movement on the importance of energy efficiency, as new crises such as this one may appear more frequently in the future.

Sports structures have been encouraged to more intelligent energy management (such as lower heating, lower air conditioning or reduced lighting). Without reaching the heaviest situation of closure of some sports structures, a wake-up call was necessary to inform sports structures of the actions they could take to reduce their energy consumption, which did not need much effort.

This new reflection, related to the energy crisis, comes with developing new provisions for energy efficiency and sustainability of the sports sector. For instance, the Dutch Ministry of Sports is working on specific subsidies for sports clubs to help the energy renovation of sports infrastructures, together with the Ministry of the Economy and the Ministry for green energy. In France, a fund established for energy renovation of infrastructures also applies to sports facilities.

It is just a start of a broader reflection that the sport movement must consider. Social impact, sustainability, waste management and energy efficiency are just an overview of the elements that need to be addressed by the sport movement in the coming years.

This comes with the observation that new crises may come after the COVID pandemic and this energy costs crisis: sports structures are aware that new events may occur, which they will have to deal with. In Sweden, for instance, 90% of the sports structures saw that they lacked the necessary tools to face such a crisis, and this observation may be shared among the whole European sport sector.

Therefore, the resilience of sports structures, which mainly rely on fragile funding sources, needs to be strengthened. However, sports structures are now aware that these issues might come back and are now central in managing sports infrastructures and activities. After the short-term priorities related to financial sustainability and energy costs management, European sports structures are also concerned with crisis management. They should be increasingly aware of those issues.